The world economy in 2023 faces a challenging landscape characterized by uncertainty stemming from various factors. Financial turmoil, high inflation, geopolitical tensions, and the ongoing effects of the COVID pandemic have created a volatile environment that impacts economic growth and stability. This article explores key aspects of the world economy in 2023, shedding light on growth forecasts, inflation trends, the natural rate of interest, debt sustainability, and the effects of geoeconomic fragmentation.

World Economy 2023: Growth Forecasts and Slowdown

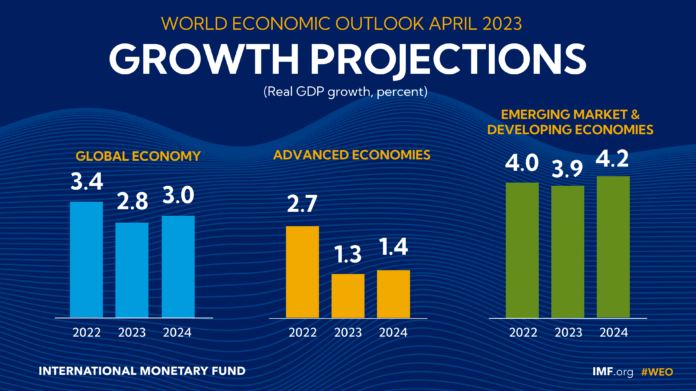

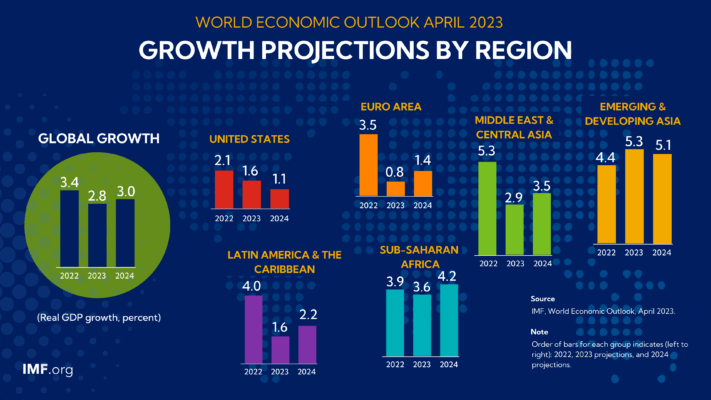

The baseline forecast for the world economy in 2023 indicates a decline in global growth from 3.4 percent in 2022 to 2.8 percent in 2023, with a subsequent stabilization at 3.0 percent in 2024. However, advanced economies are expected to experience a more pronounced slowdown, with growth rates dropping from 2.7 percent in 2022 to 1.3 percent in 2023. An alternative scenario, characterized by further financial sector stress, paints a bleaker picture for the “World Economy 2023,” with global growth plummeting to around 2.5 percent in 2023, accompanied by advanced economy growth falling below 1 percent.

World Economy 2023: Inflation Trends

While analyzing the “World Economy 2023,” it is important to consider the inflation dynamics. The forecast indicates that global headline inflation is expected to decrease from 8.7 percent in 2022 to 7.0 percent in 2023, largely influenced by lower commodity prices. However, the underlying (core) inflation, which excludes volatile components, is anticipated to decline at a slower pace. This suggests that addressing and achieving inflation targets will be a protracted process. In fact, in most cases, reaching the desired inflation levels is not expected to occur before 2025, emphasizing the persistence of inflationary pressures in the “World Economy 2023.”

World Economy 2023: Challenges and Uncertainties Ahead

Signs of a Soft-Landing Fade Amid Inflation and Financial Sector Turmoil

Early signs in 2023 that suggested a possible smooth transition for the world economy have waned, primarily due to persistent high inflation and recent upheaval in the financial sector. Although there has been a slight decrease in inflation due to interest rate hikes and lower food and energy prices, the underlying price pressures persist, and labor markets remain tight in several economies. These factors have raised concerns about potential contagion and vulnerabilities within the banking sector and nonbank financial institutions. In response, policymakers have implemented decisive measures to stabilize the banking system. However, financial conditions continue to fluctuate, influenced by shifting sentiments in the “World Economy 2023“.

Continuation of Major Forces from 2022 with Altered Intensities

The major factors that shaped the global economy in 2022 are expected to persist in the current year, albeit with varying intensities. High debt levels continue to limit the capacity of fiscal policymakers to respond effectively to new challenges. Commodity prices, which surged following Russia’s invasion of Ukraine, have moderated, but the war persists, accompanied by high geopolitical tensions. Although infectious COVID-19 strains caused widespread disruptions last year, economies, particularly China, are showing signs of recovery, which has eased supply-chain disruptions. However, despite some positive developments such as lower food and energy prices and improved supply-chain functioning, increased uncertainty resulting from recent financial sector turmoil contributes to downside risks.

Growth Outlook and Inflation Challenges

The baseline forecast for the “World Economy 2023” indicates a decline in global growth from 3.4 percent in 2022 to 2.8 percent in 2023, gradually reaching 3.0 percent in the following five years. This forecast represents the lowest medium-term growth projection in decades. Advanced economies are expected to experience a particularly pronounced slowdown, with growth rates dropping from 2.7 percent in 2022 to 1.3 percent in 2023. However, in an alternative scenario featuring further financial sector stress, global growth could plummet to approximately 2.5 percent in 2023, marking the weakest growth since the global downturn of 2001, excluding the initial impact of the COVID-19 crisis in 2020 and the global financial crisis in 2009. Advanced economy growth may even dip below 1 percent. The anemic outlook reflects the necessity of tight policy stances to curb inflation, the repercussions of deteriorating financial conditions, the ongoing conflict in Ukraine, and escalating geoeconomic fragmentation.

Inflation is projected to decline from 8.7 percent in 2022 to 7.0 percent in 2023 due to lower commodity prices. However, core inflation, which excludes volatile factors, is expected to decrease at a slower pace. Achieving inflation targets is unlikely before 2025 in most cases. Once inflation rates reach target levels, structural factors are likely to lead to lower interest rates, gradually reverting to pre-pandemic levels.

Risks and Policy Recommendations

Risks to the global economic outlook are predominantly skewed to the downside, with a higher probability of a hard landing. Financial sector stress has the potential to amplify, leading to contagion and weakening the real economy through a severe deterioration in financing conditions. Central banks may need to reevaluate their policy paths under such circumstances. Sovereign debt distress could emerge in various regions, spreading and becoming more systemic amid higher borrowing costs and reduced growth. Additionally, the ongoing war in Ukraine could escalate, resulting in further spikes in food and energy prices, thus driving up inflation. Persistent core inflation may require additional monetary tightening measures.

To improve economic prospects and minimize risks, policymakers must navigate a narrow path. Central banks should maintain their firm anti-inflation stance while remaining flexible and utilizing their full range of policy instruments to address financial stability concerns. Fiscal policymakers should support monetary and financial measures to bring inflation back to target while ensuring financial stability. Governments, in most cases, should pursue an overall tight fiscal stance while providing targeted support to those facing the challenges of the cost-of-living crisis. In more severe downside scenarios, automatic stabilizers should be allowed to operate fully, and temporary support measures can be employed if fiscal space permits. Medium-term debt sustainability requires timely fiscal consolidation and, in some cases, debt restructuring.

Allowing currencies to adjust based on changing fundamentals is crucial, but implementing capital flow management policies during crises or imminent crisis circumstances may be warranted. However, these policies should not substitute the necessary macroeconomic policy adjustments. Addressing structural factors that hinder supply can enhance medium-term growth. Strengthening multilateral cooperation is essential for building a more resilient world economy. This includes bolstering the global financial safety net, mitigating the costs of climate change, and reducing the adverse effects of geoeconomic fragmentation.

Conclusion: World Economy 2023

In conclusion, the world economy in 2023 faces significant challenges and uncertainties. The hopes for a soft landing have diminished due to persistent inflation and recent turmoil in the financial sector. The growth outlook is modest, with advanced economies experiencing a pronounced slowdown. Risks are skewed to the downside, with the potential for a hard landing. Policymakers must carefully navigate this landscape, employing both monetary and fiscal measures to address inflation, financial stability, and geopolitical risks. Strengthening international cooperation is vital to fostering a more resilient global economy and mitigating the adverse impacts of ongoing challenges.

References

https://www.imf.org/en/Publications/WEO/Issues/2023/04/11/world-economic-outlook-april-2023